I’ve read through most of the 479 pages of the Tax Cuts and Jobs Act. A lot of it was thick reading, and pieces left out that I will talk about if people ask. I tried to cover the parts that touch everyone. I also focused on the Senate Bill, as it was built on the House Bill. Both have to be reconciled. I’ll write another analysis then.

The clear message of this bill? Stop being a worker and own your own business in America.

Let’s talk about who benefits and who doesn’t.

THE CLEAR WINNERS

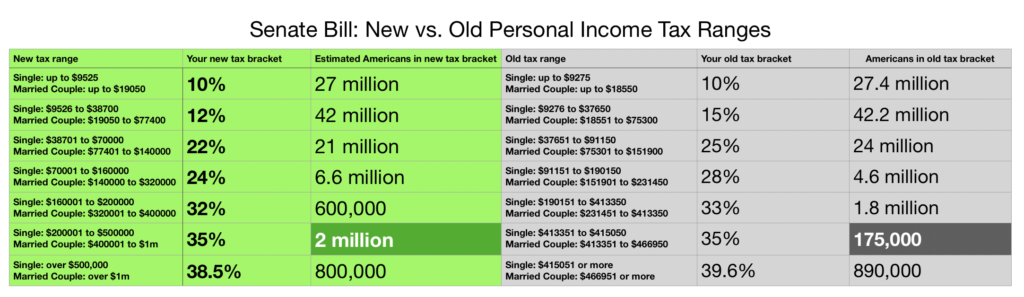

THE RICHEST. While a 1% drop might not seem like much in this income bracket (from 39.6% to 38.5%), consider that a 1.1% drop in a 1 million dollar income is $11,000. That, by itself, is more income than 27 million Americans make (see below). And the estate tax COMPLETELY going away by 2024 (Page 168, Sec 1602)?

CORPORATIONS. The tax rate for businesses falls from 35% to 20%. While most economists believe that cutting the corporate tax rate CAN lead to stimulated economic growth (if accompanied by government cuts in spending), most economists also believe that historical data doesn’t completely prove it out.

SELF-EMPLOYED “PASS THROUGH” OWNERS. A person making their money through their corporation as a “pass through” has the ultimate loophole. While there are exceptions to this rule (like lawyers and accountants), If your business is passing through its income to you and you’re making more than $500,000, you only have to pay, at most, a 31.8% tax rate vs. the typical 38.5% for your income bracket. That’s a lower rate than people who make less than a third of what you make.

THE LOSERS

THE AMERICAN WORKER. Most Americans marginally benefit from this bill (the middle class sees a small benefit), but let’s not kid ourselves: the real benefits went to business owners and corporations. There will be some groups who see tax increases due to the widening of the higher tax brackets (many WORKERS in Silicon Valley and Wall Street will be in higher tax brackets, places that also have a higher cost of living). While most Americans will see a small cut across the board, there’s no question that the Republicans need to balance their massive business tax cuts with benefits to the real engine of the economy. And they didn’t. Workers get table scraps here, and many will end up paying more over time.

THE POOR AMERICAN WORKER. Imagine that you’re getting by, making $20,000 a year, and your company gets a 15% tax cut while you get a 3% one. Kind of a bummer.

THE AMERICAN HOMEOWNER. In situations where state and local tax deductions benefit homeowners (IE, anyone who lives in a place where the cost of living is high and there are high property taxes), this is a massive blow. In some counties, people will lose as much as $50,000 in tax deductions each year on their home.

THE JURY IS STILL OUT ON…

THE REMOVAL OF THE INDIVIDUAL MANDATE. This one is a tough one, as it was one main reasons why ACA was able to work for several years. The mandate forced younger and healthier people into the system, which offset costs for everyone. Now, most experts agree that the cost in premiums will go up for Obamacare, even though nobody will be forced to buy it. This one is important to watch as it will affect millions of Americans, forcing them off of health insurance.

THE IMPACT ON THE DEFICIT. I’m willing to give Mitch McConnell and Republicans a pass on his optimistic view of the growth of the economy that will offset the trillion dollar projected addition to the deficit (even though Bob Corker and other Republicans have fiscal concerns over it). The issue is that most economists (and the joint committees who have done analysis) believe that we will not achieve the growth required to make up the difference. Time will tell on this.

WHAT I LIKE ABOUT THIS TAX BILL

THE REPATRIATION TAX FOR BUSINESSES. I actually really like the drastic lowering of the repatriation tax for money overseas (14.5 percent). 35% seems unreasonable for repatriation, in my view, as companies have already paid a tax to the local governments for money made there. This move could incentivize companies to bring their money back to the US where it could cause a boost of domestic investment. CNBC estimated that companies are holding 2.6 trillion dollars overseas. That’s 377 BILLION dollars of possible US tax income.

WHAT NEEDS WORK

CORRECTIONS TO RUSHED MISTAKES. There are so many simple mistakes in the bill, like the Corporate AMT being at 20% when the Corporate Tax Rate dropped to the same level. This literally makes no sense. And there are new taxes for University endowments, but seemingly no definition anywhere.

THE PROCESS IN BOTH THE HOUSE AND SENATE. We need our Senators and House to work in a bi-partisan manner. The process is broken in government right now. Our leaders need to stand on the side of our party, not our country.